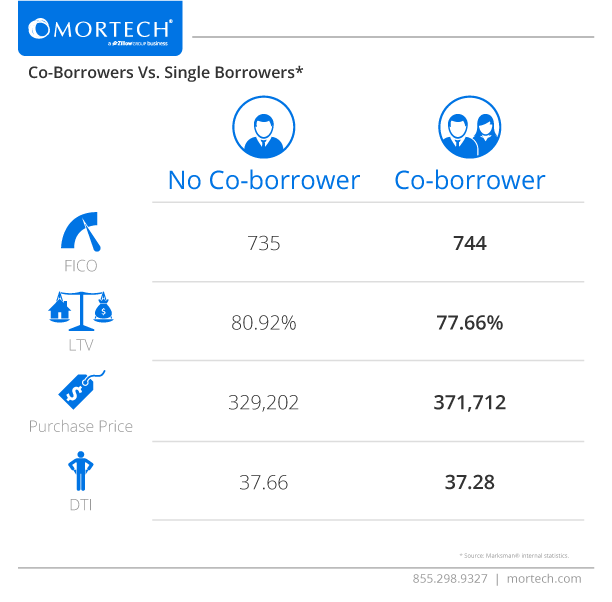

As Valentine’s Day approaches, many couples will be sharing dinner, a night at the movies, or some other form of a romantic evening. However, we were curious about the idea of sharing something a little different: a mortgage loan. We pulled some data from Marksman to compare co-borrowers and single borrowers, to see if there was an advantage to having a second borrower on a loan, or if it’s better to fly solo.

Looking at the compiled data, the answer seems pretty obvious: co-borrowing appears to be the way to go in most cases. Co-borrowers had a higher average FICO than single borrowers, and typically had a higher purchase price than those taking out a loan on their own. Co-borrowers also had a lower average LTV and DTI, making for a clean-sweep of advantages over single borrowers.

Of course, there can be drawbacks to co-borrowing as well. Putting someone else’s name on a loan surrenders complete control over decisions made regarding the loan, and some borrowers might not want to lose that control. Others might want to co-borrow, but don’t have an advantageous FICO score, so that the average score between the two borrowers would drop substantially. So, while co-borrowing is shown to have its advantages, they aren’t so vast that a lender borrowing on their own isn’t an option either. If a borrower is on the fence about co-borrowing, though, it might be a good idea to show them the advantages they could have from doing so.