We recently announced a new integration with Ellie Mae’s Encompass®, providing a third party origination (TPO) solution for our users. The new integration streamlines pricing and offers a centralized, secure web portal for lenders and third party originators to collaborate throughout the loan process. The integration allows for lenders to transmit proprietary pricing from Mortech for distribution of both initial and intraday rate changes, while also including base rates, SRPs, LLPAs, and layered profitability.

While there are several practical reasons to utilize this integration, we wanted to show some concrete, statistical reasons why and how this TPO integration helps TPO users on Marksman® with regard to bringing in leads and a higher quote volume. Using data from Marksman, we examined some different stats and results between TPO and non-TPO users.

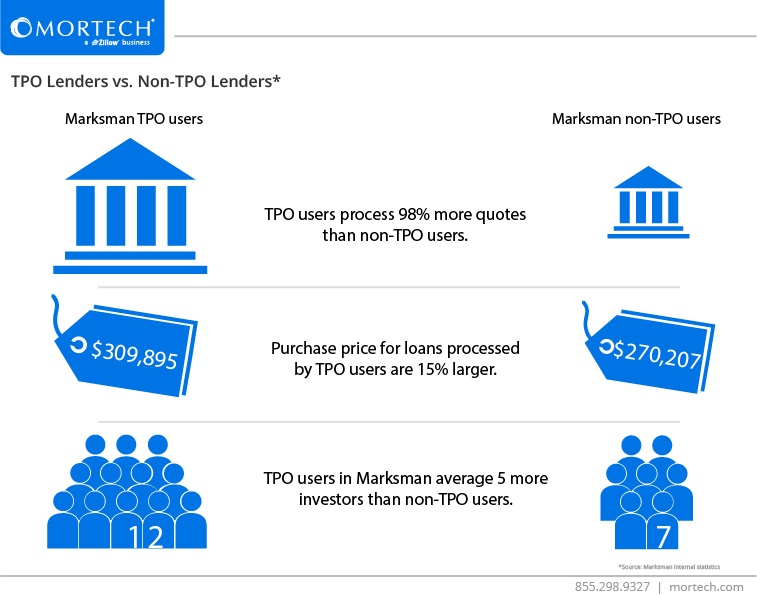

As the data above illustrates, TPO users in Marksman process 98% more quotes than non-TPO users. Loan size is substantially larger as well, with TPO users processing loans that are 15% larger than those processed by non-TPO users. TPO users also have an average of five more investors than non-TPO users, making for more competitive pricing online for their borrowers.