Finding the right pricing engine to become a supported investor on can be difficult. You need to make sure that the company you trust isn’t just putting your products in front of anybody and everybody, but in front of the right borrowers and in the right location. Not only that, but you need the rates that pricing engine is quoting to be accurate and updated at all times, so that borrowers are getting all of the right information, and preventing looking like you’re offering old or inaccurate rates.

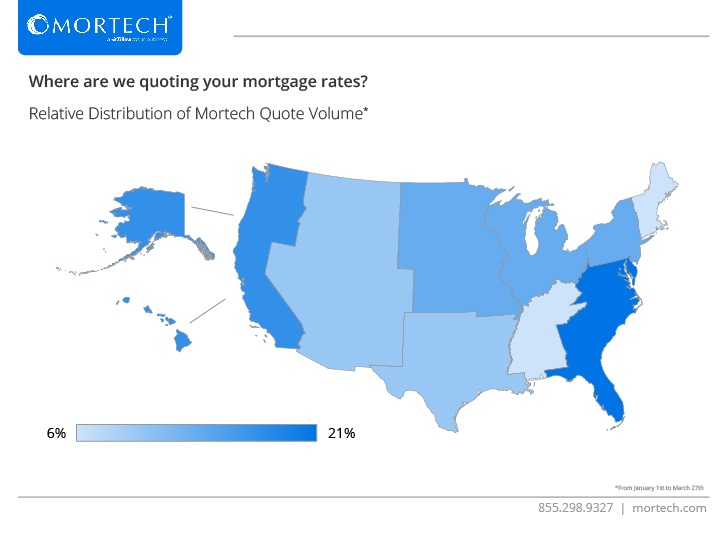

Our user base stretches across the country, with each region of the U.S. accounting for at least 6% of our rate quote volume so far through 2018. No matter where your customers are using your products, Mortech has users there. Only want your products available in one region? With Mortech, you don’t have to worry about not having coverage.

Mortech can create and upload a wide variety of custom rate sheets to offer in our mortgage engine. We’ll also automatically update those rate sheets whenever intraday rate changes occur. Your rates won’t just be accurate at all times, but you won’t have to worry about being the one constantly going in and updating them.

.jpg)

.jpg)