Fannie Mae and Freddie Mac have both announced their versions of the new low down payment program as promised earlier by Mel Watt, director of FHFA, the conservator for both agencies. There are many similarities and some differences in the respective Agency’s program.

Fannie Mae and Freddie Mac have both announced their versions of the new low down payment program as promised earlier by Mel Watt, director of FHFA, the conservator for both agencies. There are many similarities and some differences in the respective Agency’s program.

Fannie Mae (Loans may be delivered on or after December 8, 2014)

FNMA offers two different options for its 97% Loans---their regular program and also one through the My Community Mortgage program. The attributes that apply to both options are:

1) LTV is limited to 97% and CLTV can be up to 105% (Community Seconds Only)

2) Must be a Fixed Rate Product with a term of 30 years or less

3) Must be DU underwritten

4) Only 1-unit principal residence (including condos and PUDs; manufactured housing is not eligible)

5) At least one borrower has to be a First Time Homebuyer

6) On R/T refis –the loan being refinanced must be owned by Fannie Mae

The differences in the regular program and the MCM options are:

1) MCM loans are subject to the MCM income guidelines

2) MCM loans only require 18% MI coverage, rather than the 35% coverage required on the regular program

3) Pre-purchase homebuyer education and counseling only required on MCM

4) Post-purchase early delinquency counseling only required on MCM

5) Pricing adjustments-- MCM standard LLPA (0.75%) and the regular program is subject to the Standard risk-based LLPAs (based on credit score and LTV range)

Freddie Mac (Loans may be delivered if settlement date is on or after March 23, 2015)

Freddie Mac has just one option that they have named Home Possible Advantage. Their program attributes are as follows:

1) LTV limited to 97% and CLTV can be up to 105% (Community Seconds Only)

2) Only 1-unit principal residence (including condos and PUDs; manufactured housing is not eligible)

3) Can LP underwritten or manually underwritten

4) Must be a Fixed Rate Product with a term of 30 years or less

5) Income limits are up to 100% of the area median income with no income limit in underserved areas

6) At least one borrower must attend Homebuyer Education class if all borrowers are First Time Homebuyers

7) MI coverage is 18%

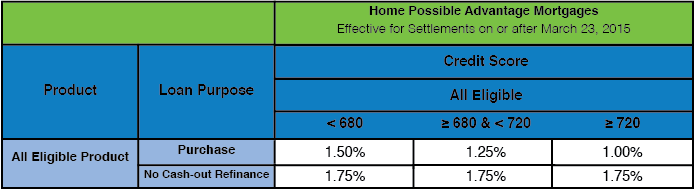

Pricing Adjustments are:

Freddie Mac has delayed delivery on the product in order for them to make the appropriate changes to their IT systems. Need a faster way to re-price loans due to a change in LTV? Check out our Historical Pricing feature.