The mortgage industry has long since been driven by technological innovation. Lenders that embrace technological changes and use them to improve their daily processes and streamline their workflow continuously find themselves ahead of the curve, offering superior customer service and setting themselves up for long term success.

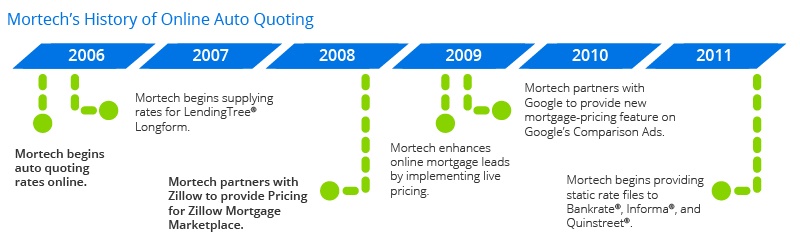

Ten years ago, the entire technological landscape of the mortgage industry shifted, with Mortech leading the charge. In 2006, we introduced online auto quoting, making it possible to upload rates online and share with consumers automatically. This gave lenders the ability to post their rates across different online marketplaces, reaching thousands of borrowers that they never could’ve serviced without this capability. The introduction of online auto quoting has since empowered lenders to create flourishing Consumer Direct divisions with expansive online footprints, and provide their rates to more borrowers than ever before.Through the years, online auto quoting has survived and thrived, with new innovations being made and more marketplaces being added, providing lenders with diversification.

Since introducing auto quoting in 2006, Mortech began quoting rates to several different marketplaces, expanding our reach to sites like Zillow®, Bankrate®, LendingTree®, Informa®, and Quinstreet®. By 2012, the efforts Mortech put toward working with these marketplaces to post rates online began to show.

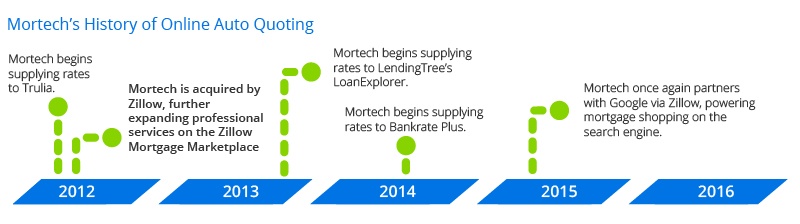

Mortech was again growing its reach by adding more marketplaces, such as Trulia and an enhanced version of Bankrate’s static file in Bankrate Plus. But Mortech was also expanding professional services provided on other marketplaces as well, and in 2012, when acquired by Zillow, Mortech began supplying more and more rates to the Zillow Mortgage Marketplace.

Providing users with marketplaces with which to share their rates and expand their online footprint is something that Mortech has always striven for, and seeing the growth over the last ten years of online auto quoting reaffirms that idea. With more marketplaces to quote rates on and millions of rate quotes being processed every day, Mortech users can get their rates in front of more online borrowers than ever before.

To find out more about how you can start posting your rates online across those marketplaces to millions of borrowers, or how you can be setup as a marketplace to have our lenders’ rates posted on, contact Mortech today. Or if you’re already a Mortech user and want to know how you can quote your rates online to more of these marketplaces, you can contact your account manager.