Finding new opportunities to boost your mortgage purchase business as the mortgage industry ebbs and flows can be a hassle. Why come up with a number of different outbound marketing options that force you to cast a wide net – and typically spend the most money. Instead, you should be using targeted data that identifies current customers who are ready for a mortgage. Not having that reduces your efforts to throwing various methods at a wall and seeing what sticks. You end up spending so much time and effort into reaching out to customers who may have no need for a mortgage, and by the time you reach those who do, you’re no earlier than your competition.

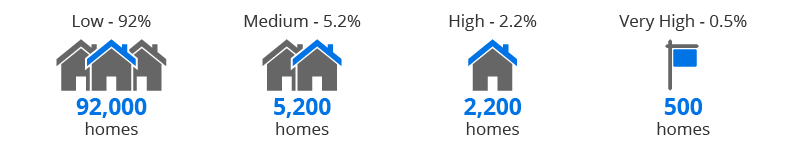

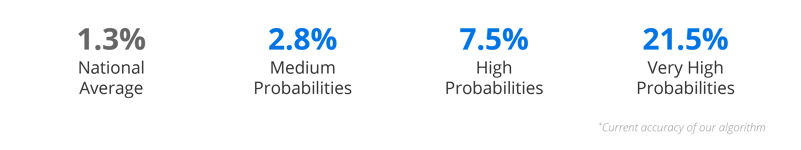

With Mortech Protection, you don’t have to waste time and money on casting a wide net with your outbound marketing. As the refinance market dries up and you’re trying to retain your current customers, you simply upload addresses in your customer database you’d like Mortech to monitor through Mortech Protection. We then return results to you, tiered by chance of the address listing in the next 90 days. With Mortech Protection, out of a database of 100,000 homes, you can expect results like this:

As the market changes based on seasonality and other factors, you’ll see those numbers change slightly. However, based on our current data, these are results you can find within your database through Mortech Protection.

You don’t have to spend any more of your time making email campaigns, cold calls, and generic mailers. With Mortech Protection, you know exactly who to market to and can send the right message at the right time. It’s about time you took your time back, and Mortech Protection can help. Contact us today to learn more about how Mortech Protection can start retaining your customers and saving your time.

![]()