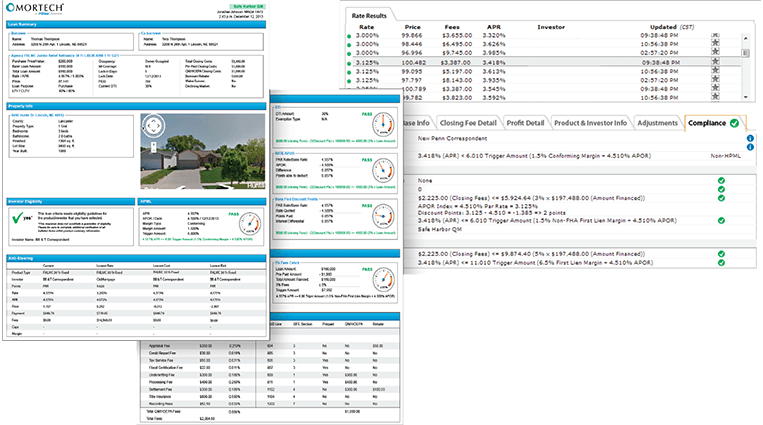

Identify compliance issues early in the loan process, before it gets sent to underwriting.

Mortech’s suite of compliance tools includes automated tests and a comprehensive compliance review sheet available for your loan officers and secondary desk - giving your team the correct tools to double check the rate quote and make any necessary pricing adjustments before the loan gets locked. Automated checks include:

SOC 2® - SOC for Service Organizations: Trust Services Criteria

Report on Controls at a Service Organization Relevant to Security, Availability, Processing Integrity, Confidentiality or Privacy. These reports are intended to meet the needs of a broad range of users that need detailed information and assurance about the controls at a service organization relevant to security, availability, and processing integrity of the systems the service organization uses to process users’ data and the confidentiality and privacy of the information processed by these systems. These reports can play an important role in:

Similar to a SOC 1 report, there are two types of reports: A type 2 report on management’s description of a service organization’s system and the suitability of the design and operating effectiveness of controls; and a type 1 report on management’s description of a service organization’s system and the suitability of the design of controls. Use of these reports are restricted.